Last Updated on July 17, 2023

How to Build the Perfect Chart of Accounts for a Construction Company

Keeping track of all the money moving in and out of your construction business can be challenging. What if you had to quickly find out the dollar amount on an invoice that was issued a year ago? You might have to rummage through a pile of paperwork, going through orders one by one for hours. What if you had to report on all accounts payable within the two months that followed – but suddenly realized that some documents are missing? That would be a nightmare….Unless you used a chart of accounts.

A chart of accounts allows you to track every transaction by category and subcategory. This way, you can see exactly where your business is making and spending money. Everything from a new bank loan to an invoice from a supplier is recorded in an appropriate category, making it easy for you to locate any bit of financial data.

Whether you operate a construction or service business, you need a chart of accounts (COA). In this article, we will break down everything you need to know about a chart of accounts and how your construction or service company can successfully use one.

A chart of accounts (COA) is a fundamental tool to help organize financial record-keeping and is foundational in setting up all accounting systems. As you read through the article, keep the following in mind:

- COA is an essential product of a company’s financial recording and reporting system.

- COA provides the structure to organize different types of transactions and make them easier to find.

- COA is an organized way to record financial transactions.

All financial transactions need to be documented, and you need a reliable structure in place to organize your records. Creating a chart of accounts for a construction company has its challenges, but this article provides you with the foundations to get started.

We do want to note – since we are a software company, our opinion is that it’s in your best interest to use a software tool, specifically one designed for construction business accounting, in order to help track your transactions once you’ve built your COA.

But that said, we’re here to help, and hope that this article does that for you!

Now that we are familiar with the benefits of charts of accounts, we can start to apply this knowledge to create our construction chart of accounts. First things first, let’s take one step back…

What Exactly Is a Chart of Accounts?

Being in the construction industry, you know that having a blueprint is essential before you start doing any work at the construction site. When it comes to accounting and finances in general, a chart of accounts is your blueprint. You can accurately account for income, better track expenses, and use your chart of accounts to build reports and easily assess your company’s financial health.

Originally, this type of processing financial transactions involved separately labeled drawers for each type of accounts. Luckily, modern accounting software makes life easier for accountants by automatically labeling and categorizing the entries, which makes them easier to track and locate.

A chart of accounts, or COA, is a listing of all the financial accounts in a construction company’s general ledger (GL). Accounts are grouped into categories that correspond to the structure of a company’s financial statements. The chart is formed by a list of numbered accounts with the account names and their brief descriptions.

Accounts are numbered in a commonly accepted structure so that every account appears in the same order. Depending on the organizational structure of your construction business, an account number can be three or four digits long.

Here is a standard list of account numbers setup:

1000 – 1999 Assets

2000 – 2999 Liabilities

3000 – 3999 Equity

4000 – 4999 Income or Revenue

5000 – 5999 Job Costs/Cost of Goods Sold

6000 – 6999 Overhead Costs or Expenses

7000 – 7999 Other Income

8000 – 8999 Other Expense

This list of accounts provides the structure for your company’s financial statements and is designed to provide the information needed for financial reports.

How the Chart of Accounts Supports Your Construction Business

The chart of accounts, for a construction company, helps organize financial transactions in order to build financial statements. When a transaction is entered, it becomes recorded in the accounting system. Financial statements summarize the amounts of transactions over a given period of time. Think of it like a blueprint that outlines the way your financial building is being constructed.

Consider the following best practice – Start with a fairly standard chart and add the most important accounts. Then wait a couple of months and consider adding a few more depending on your way of categorizing the expenses or income. You may also consider redefining or renaming accounts to make the structure defined more clearly.

Why a Chart of Accounts Is Important?

There are several reasons why having a well-designed chart of accounts is essential for the financial health of your construction business:

- Consistency: all recurring transactions go to the right account month after month, so you have an actual picture of how much is being spent and earned.

- Accurate business decisions: Clearly structured COA provide you a better understanding of how your business performs overall. This makes it easier to lay out reasonable growth plans or identify the right time to seek investments.

- Ease of use for employees: with a defined and organized account structure, there’s no guesswork in where to post new transactions. For example, your new hires will spend less time onboarding, and that is a win-win for everyone.

What Makes a Chart of Accounts for a Construction Company Unique?

Construction-specific accounts include many items that are common to contractors, such as business and building permits, outside labor, mobile restroom rental, or catering services for laborers.

Contractors have multiple income streams and their income is recognized upon work completion. In comparison, suppliers usually have an easier account structure. They recognize income when materials are sold and there’s no need to track the project progress.

Let’s take a look at the most significant accounts that must be included in a construction COA.

Important Accounts for Construction Companies

As you start to build your COA, consider using the following standard accounts and expenses. Each of these will be reflected in your financial statements, including the balance sheet and the income statement. As expenses and costs come in from jobs, they get allocated to the correct area of COA. This way, you have an ongoing account of what’s happening.

Assets

Asset accounts belong to the first category on your chart of accounts, for example, Cash or Accounts Receivable. When you create your asset accounts, consider all the things your business owns or anticipates to own during the fiscal year.

Construction businesses usually have two primary asset account groups: current assets and long-term assets.

Current Assets Accounts

These accounts track any assets that a company is expected to utilize, sell, or consume during the next 12 months, or before the end of the current fiscal year – For example, materials, and equipment. The current assets section in this category usually contains accounts such as:

- Bank accounts and cash

- Account receivables: money owing to you for the work done

- Retention receivable: money on hold until the work is finished

- Inventory on hand that comes from suppliers

- Prepaid expenses such as insurance

Generally, current assets are anything that can generate cash within 12 months, as well as resources required to continue your day-to-day operations or cover current expenses.

Capital Assets

Also called long-term assets, these assets are used in construction business operations to generate profits during a period of time of longer than one year. Capital assets include property, plant, and equipment (PP&E), for example:

- Machinery

- Computers and office equipment

- Vehicles

- Buildings

- Land

- Accumulated depreciation

Capital assets can also include Noncurrent Assets which are intangible, such as patents and copyrights. These assets may produce value in the long term and characteristically cannot be easily converted to cash. Organization costs such as special licenses and legal fees are also intangible noncurrent assets.

Noncurrent assets also include long-term investments, such as bonds and stocks, as these assets tend to remain on the balance sheet for longer than one fiscal year.

When it comes to your construction work-in-progress, it is tracked as a part of the PP&E, (property, plants, and equipment account).

In general, all assets that are used to fund long-term or future needs are reflected in capital assets accounts.

Job Income Accounts

Most construction trade companies perform more than one service, but if your company offers one specific service, then common practice is to have a single income account called “Job Income”. This way, you can avoid the hassle of tracking different income accounts. To help achieve clarity during reporting, you can add more detailed descriptions of services offered.

Expenses

These accounts record any expenses that are incurred by the project to earn revenue. Expenses are divided into:

Labor

Whether it is day labor or the company’s labor, all wages of laborers, site engineers, administrative staff, technicians, drivers, and other people working on-site go into these accounts.

Materials

These accounts track all materials purchased for project or service implementation, such as sand, cement, gravel, bricks, carpentry, electrical, plumbing materials, and more.

Overhead

These expenses include equipment rental, transportation to the site, security and utilities on the site, subcontractor costs, and similar. For example, overhead expenses may include accounting fees, advertising, insurance, interest, legal fees, labor burden, phone bills, or travel expenses.

Operating Expenses

Unlike overhead expenses, operating expenses result from the normal operations of your construction or service business. Any expense that keeps the business running, beyond direct materials and labor, falls into this group. Operating expenses in the construction industry include rent, wages, utilities, administration expenses, maintenance, and repairs, among others.

Examples of direct expenses:

- Administrative costs: administrative operations, construction management software.

- Office expenses: office rent, supplies, postage.

- Phone expenses: costs of equipment and contracts for field workforce.

Examples of indirect expenses:

- Taxes: sales and business income taxes.

- Insurance: general liability, automotive, workers comp, and other coverages.

- Vehicle expenses: costs of fuel and maintenance for vehicles utilized in the field

Non-Operating Expenses

Expenses that belong to this group aren’t related to your core operations and occur infrequently. Amortization, depreciation, obsolete inventory charges, long-term investments, trademarks, losses from the sale of assets, or restructuring expenses all fall under this category. It may be helpful to separate non-operating expenses from operating ones in your chart of accounts.

Current Liability

This is the opposite of current assets. Current liabilities are anything that reduces a company’s spending power for the fiscal year. These could be:

- Short term debts

- Income taxes due

- Accounts payable

- Interest payable

- Bills payable

- Bank account overdrafts

- Accrued expenses

Current liabilities are due and owing in one fiscal year. It’s important to stay on top of your liabilities to ensure that your company can meet its short-term obligations and have sufficient working capital or access to funds.

Payroll Expenses

The amount you pay to employees for their labor, employee benefits, and state and federal payroll taxes all fall under the payroll expenses category. In the construction industry, payroll expense is the biggest expense category, so it is critical to managing payroll expenditures carefully. Payroll expenses can include:

- Wages and salaries

- All related payroll taxes

- Benefits

Payroll is one of the most significant expenses that affect cash flow for any construction business. With a large workforce and multiple projects, managing payroll can become time-consuming and stressful. Chart of accounts helps to stay on top of payroll, reducing time to pay your laborers. This in turn improves workforce motivation.

Costs of Goods Sold

Cost of Goods Sold accounts are very important because they track labor costs, including wages, benefits, and employer taxes. Cost of Goods Sold also tracks raw materials required for the finished product, subcontractors and trade contractors, and the cost of rental or owned equipment. Among the most common accounts for construction businesses are:

- Small Tools and Equipment

- Equipment Rental

- Job Materials Purchased

- Workers Compensation

Cost of Goods Sold makes up a large part of construction contractors’ expenses. Your COA helps to track these expenses and to keep them separate from operating expenses which is key for estimating job profitability.

Tips for Creating Your Chart of Accounts

Now that you have learned the essential parts comprising a chart of accounts, you can engineer a COA that grows with your construction business and helps you succeed. Here are some of the best practices to guide you in this process.

Always start with a blueprint

As with any major project, you need a framework that meets your demands. To begin with, define the factors that impact your chart of accounts, for example, reporting requirements or expressed needs of stakeholders. 40% of CFOs confirm that reporting demands have increased and the reliable insight into financial health and performance becomes a top priority. In this case, COA becomes a hub of financial data pulled from across the company.

Designing your chart of accounts around the blueprint, and then fine-tuning account-level details make it easy to identify financial categories for your balance sheets, financial reports, and income statements.

Be trade-specific

When putting together a list of expense accounts, it is best to consider the requirements of your specific industry. A landscaper may choose to have accounts for repairing heavy machinery and for purchasing mulches, trees, and shrubs. An HVAC business, on the other hand, may have expense accounts for truck rental and the purchase of spare parts.

Future-proof your COA

Revising your chart of accounts every couple of months is simply not practical. Design a flexible COA that lasts as long as possible and grows with your company. For example, create large enough numerical account identifier ranges to accommodate future growth.

Design your COA around numbers

When you use numerical values as account identifiers, you end up keeping your general ledger ordering systems simple. Numbers make it easier for humans to read and enter data, and accounting software loves numbers, too. Keep your numbering system simple and logical.

Don’t underestimate subaccounts

You can structure your sub-accounts around the nature of your business and operations. But don’t overkill. If your account structure becomes too complex, the entire accounting system will be affected and you may face additional accounting issues leading to clarifications and corrections.

Minimize the number of accounts

This helps to reduce the chances of having repeat and unnecessary accounts in your COA. Keeping your COA lean also eliminates clutter in transaction posting and reporting. Fewer accounts mean increased processing speed and reduce accounting time. You need to find a balance between the number of accounts and the required amount of detail.

Keep things clear and simple

Stick to standard account numbering and description practices. Make sure that each description provides enough information so that a new person on a job could dive in and easily make themselves familiar with your system.

Avoid frequent changes to your chart of accounts

Once you have established the overall structure of the chart, the best practice is to avoid changing it. If you’re going to make changes, it’s best to do so at the beginning of the fiscal year. Whenever in doubt, consult with your accountant to avoid confusion.

How Jonas Construction Software Can Help You Build the Perfect Chart of Accounts

Developing a chart of accounts is an important part of setting up your accounting and bookkeeping processes. In fact, it is the basis of your construction company’s finance system. A carelessly designed COA fails to provide visibility into all the accounts and transactions, a well-designed COA can drive real business benefits.

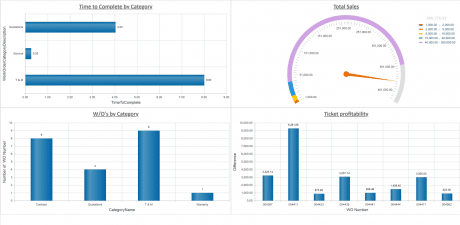

Advanced construction accounting software helps you build a solid financial foundation for your construction business. With a proper COA supported by construction accounting software, you can accurately account for income and expenses, and also easily create reports to assess your company’s financial health.

In addition to the usual expense accounts, you will have the tools to stay on top of construction-industry-specific accounts, such as business and building permits, outside labor and service expenses, for example, mobile restroom rental and catering services for laborers. Wherever you are, whatever the time of day or night, you will always have the most recent view of your accounts.